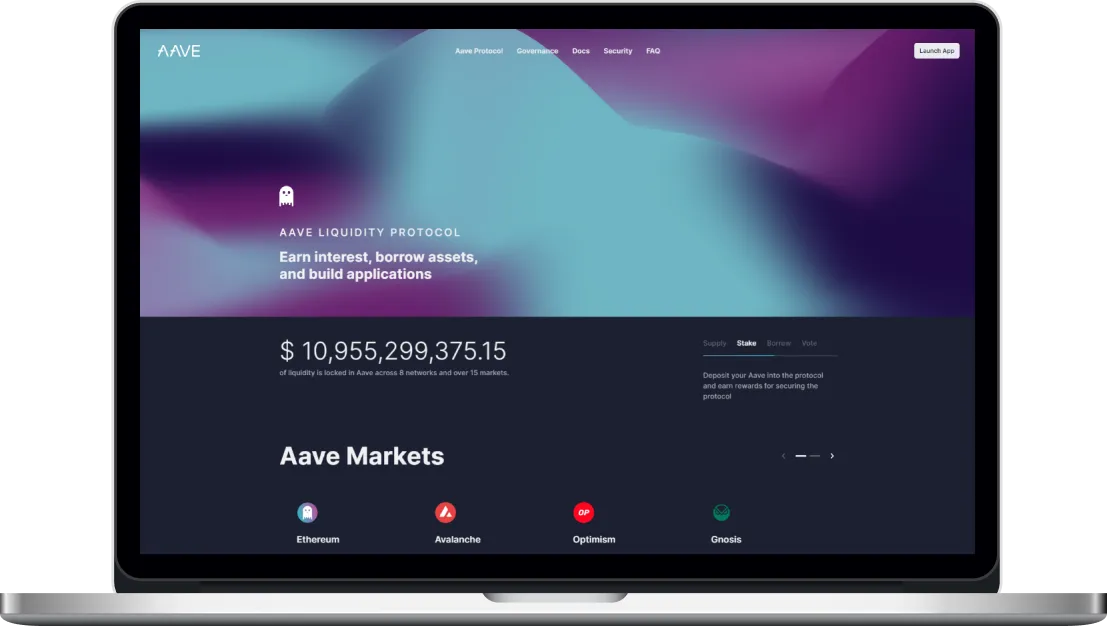

Lend and Borrow Digital Assets Seamlessly with aDeFi WebApp Like Aave

About Webapp Like Aave

Imagine Aave as the Lego of Decentralized Finance which provides the building blocks that is smart contract for lending, borrowing and earning interest on various cryptpcurrencies and trade across multiple DeFi platform with few clicks.

FinTech

HTML

Node.js

Regular

UI/UX

Secure Data And Digital Activity Tracking Solutions

Emerging Business

Consult Our Experts

Our Process

Smart Contract Development

Will Write Self-Executing Code for Secure Transactions

Front-End Design

Design Simple and Intuitive Layout for Easy Navigation

Back-End Integration

Integrate Server-Side Operations with Blockchain Functionalities

Security Audits

Regular Checks to Find Out and Fix Potential Vulnerabilities

Flash loans Staking and Integration with Decentralized Exchanges (DEX)

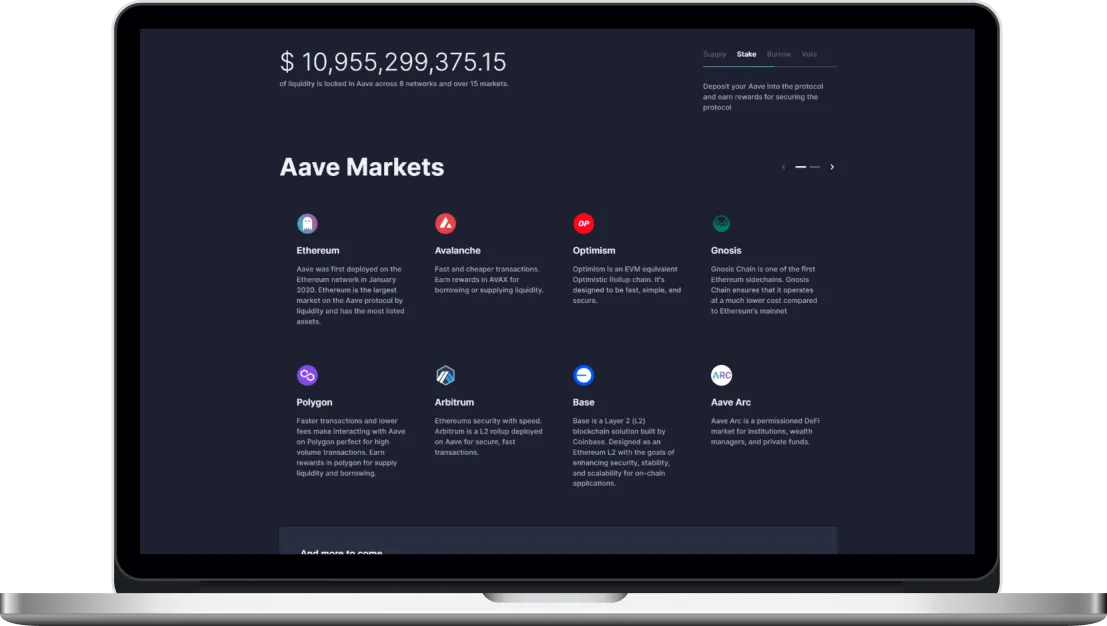

In this cutting-edge decentralized finance webapp designed to revolutionize the way you interact with digital assets.Platform similar to Aave, specializes in providing seamless lending and borrowing services whether you are looking to earn interest on your crypto holdings or need quick access to funds by using assets as collateral.Dive into the world of possibilities with our unique flash loans feature, allowing you to access instant, uncollateralized loans for a wide range of financial activities. Engage in yield farming and staking to maximize your returns, as you lock in your assets to earn additional tokens or rewards.Experience the future of trading with our integrated decentralized exchange (DEX) functionality. Trade your assets directly from our webapp, taking advantage of advanced features like limit orders and stop-loss orders and enjoy a secure and efficient trading experience without relying on centralized intermediaries.

Tanθ Development Journey With Aave App

At Tanθ, we are committed to bringing you a cutting-edge webapp that seamlessly integrates with the world of decentralized finance. Development journey is fueled by a passion for creating a user-friendly space where you can explore financial opportunities with ease.Web application focuses on simplicity and user centric design and our development process involves thorough attention to detail in crafting a user interface that is not only aesthetically pleasing but also intuitively navigable.Tanθ is not just about the financial empowerment but its a journey towards creating a space where you can lend, borrow and explore the endless possibilities of enhancements and acollaborative environment that values your feedback and input. So join us on this exciting journey into the world of decentralized finance like Aave webapp.

Our Fundamental Benefits In Aave App

Explore the core advantages and fundamental benefits that sets us apart in the realm of decentralized finance. At our webapp, we prioritize user experience security and innovation, aiming to provide a platform that empowers you in your financial journey.

Secure And transparent transactions

In our Aave-inspired webapp, security is important and benefit from a robust system built on blockchain technology, ensuring the integrity and transparency of every transaction. Our commitment to security extends to regular audits, safeguarding your assets and transactions.

Flexible Lending and Borrowing Options

Enjoy the flexibility to lend your assets and earn interest or borrow against your holding with ease. This platform provides a user-friendly interface for managing loans, choosing interest rates and collateral options. Tailor your financial strategy according to your needs.

Innovation Flash Loans for Instant Transactions

Explore the power of flash loans which enables you to access instant, uncollateralized loans for a myriad of financial activities. This innovative feature allows you to execute quick transaction without traditional collateral requirements, providing new opportunities for traders and investors.

Intuitive User Interface and Accessibility

Navigate our platform effortlessly through an intuitive user interface. Designed with simplicity in mind, webapp ensures that both novices and experienced users can access and utilize DeFi services seamlessly. Enjoy a user-centric design that prioritizes accessibility and ease of use.

Our Project Challenges

Navigating The Landscape of Innovation

Embarking on the development of a webapp akin to Aave presents us with a series of challenges that we are eager to tackle head-on. One significant hurdle lies in navigating the dynamic landscape of innovation within the decentralized finance space.Staying ahead of emerging technolgies and evolving user expectations demand constant vigilance. Striking the right balance between innovation and stability is important, ensuring that our webapp remains robust and resilient in the face of the ever-changing blockchain ecosystem.

Security and User Trust

Ensuring the security of our web application is a important challenge that we take seriously. With the increasing sophistication of cyber threats, safeguarding user funds and data requires a thorough approach to code audits and continuous security assessments.Building and maintaining a high level of trust among all users is essential for the success of our project. Addressing potential vulnerabilities, implementing robust security measures and promoting transparent communication about the security practices we follow strictly are key components to overcome this challenges.

What is Aave and How does it work?

Aave is a decentralized finance platform that allows users to borrow and lend various cryptocurrencies without the need for old intermediaries like banks. It operates on the Ethereum blockchain and utilizes smart contracts to facilitate lending and borrowing transactions.Users can deposit their crypto assets into liquidity pools, earning interest over time. Borrowers can then take out loans by providing collateral and paying interest and Aave introduces the concept of flash loans which enables users to borrow funds without collateral but within a single transaction block.

How is Aave different from traditional banking system?

Aave stands out from traditional banking by utilizing blockchain technology and smart contrats. Unlike traditional banks, Aave operates on a decentralized network, eliminating the need for intermediaries and centralized control. In Aave users have direct control over theoir funds and transactions are executed automatically through smart contracts, reducing the risk of fraud or manipulation.Additionally, Aave enables global and instant transactions without geographical restrictions, providing financial services to users worldwide. Aave represents a paradigm shift in the financial sector, offering a decentralized alternative to old banking systems.

What is the risk associated with lending and borrowing on Aave?

While Aave strives to provide a secure platform, there are inherent risks in decentralized finance. Lenders may face the risk of borrowers defaulting on loans, lending to poetential loss of funds. Borrowers are exposed to the volatility of cryptocurrency prices as collateral values may fluctuate.Aave has implemented risk management features like overcollateralization requirements and variable interest rates, to mitigate these risks. Users are encouraged to thoroughly understand these aspects and assess their risk tolerance before participating in the webapp.

How does Aave ensure the security of user funds?

Aave places a strong emphasis on security and employs various measures to protect user funds. Smart contracts undergo strict audits by reputable third party firms to find out and rectify vulnerabilities.Additionally, Aave implements decentralized governance, allowing the community to participate in decision-making processes, making the platform more resilient. Users are also encouraged to enable additional security features on their wallets like two-factor authentication to enhance account protection.

Client Testimonial

We’d love to hear from you

We have offices and teams all around the world.

Contact Us

+91 63549 53278 | [email protected]

Complete the form below and we will contact you to discuss your project.

- Games

- India

- United States

316 8th Avenue, New York, NY 10012, United States

[email protected]

- Canada

40 A, 100 Main St E, Hamilton, Ontario L8N 3W7

[email protected]

- UAE

406, Building 185 Street 10,Jebel Ali Village,Discovery Gardens

[email protected]

- United Kingdom

28 S. Green Lake Court Fleming Island, FL 32003

[email protected]